Trading – flexible, effektive und lukrative Geldanlage

Altbewährte Geldanlagen, wie Spar-, Tages- und Festgeldkonto haben aufgrund niedriger Zinsen und hoher Kosten ausgedient. Riskante Geldanlagen sind zu volatil und enden im schlimmsten Fall mit einem Totalverlust. In den Handel einsteigen kann jeder, denn die Voraussetzungen sind gering.

Das bringt viele Vorteile:

- große Auswahl

- viele bekannte Unternehmen

- geringe Investitionskosten

- niedrige Gebühren

- flexibel & transparent

- für kurz- und langfristige Anleger geeignet

Worauf bei der Broker-Wahl achten?

Ein Broker fungiert als eine Art Schnittstelle zwischen Ihnen und den Börsen. Er stellt Ihnen eine Handelsplattform, über die Sie einfach kaufen und verkaufen können, zur Verfügung. Aufgrund der großen Beliebtheit müssen Sie sich zwischen vielen Brokern entscheiden. Anhand einiger wichtiger Kriterien finden Sie in kürzester Zeit einen passenden Anbieter:

Achten Sie darauf, dass der Broker durch eine Aufsichtsbehörde, wie die CySEC oder die BaFin reguliert wird. Entscheiden Sie sich nur für einen sicheren, seriösen und erfahrenen Broker. Wählen Sie einen Broker mit einem guten Ruf, einem transparenten Kostenmodell und niedrigen Gebühren.

Sie können über den PC und mobile Endgeräte handeln. Die Wahl des Brokers bestimmt, welche Plattformen Sie verwenden. Es gibt Programme, die Sie auf Ihrem Computer installieren und Handelsplattformen, die direkt im Browser laufen. Professionelle Plattformen, wie der Meta Trader 4, eignen sich für Anfänger und Profis. Sie besitzen viele Funktionen und lassen sich dennoch leicht bedienen.

Nach diesen Kriterien bewerten wir!

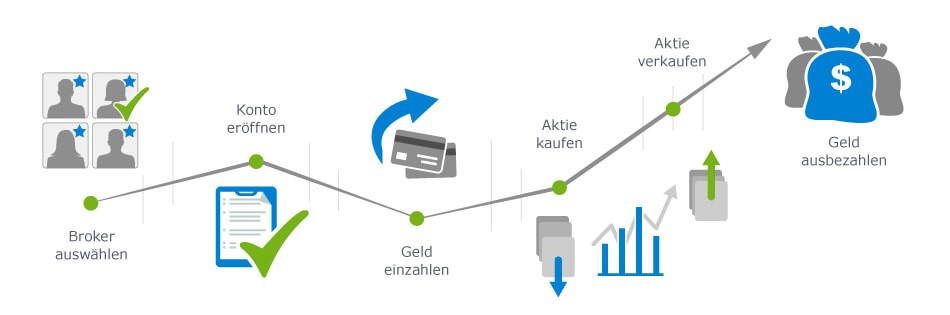

Schritt für Schritt über einen Broker handeln

- einen sicheren, seriösen und günstigen Broker auswählen

- ein neues Konto beim Broker erstellen

- das Handels-Konto verifizieren

- eine Einzahlung vornehmen

- die Handelssoftware installieren oder die Plattform über den Browser aufrufen

- nach geeigneten Möglichkeiten suchen

- kaufen

- halten

- mit Gewinn verkaufen

So funktioniert der Handel

Über einen Broker handeln Sie ohne großen Aufwand. Zur Wahl stehen alle bekannte Unternehmen, mit denen Sie handeln können. Sie eröffnen in Minuten einen Account und können nach der Einzahlung sofort mit dem Handel beginnen. Empfehlenswerte Broker sind seriös und sicher. Erfahrene Broker überzeugen mit einer großen Auswahl, geringen Gebühren und einer einfachen Bedienung.

In 5 Minuten zum Kauf